Debt structure

Signify’s debt consist of Bonds, Schuldschein and Term Loans in EUR.

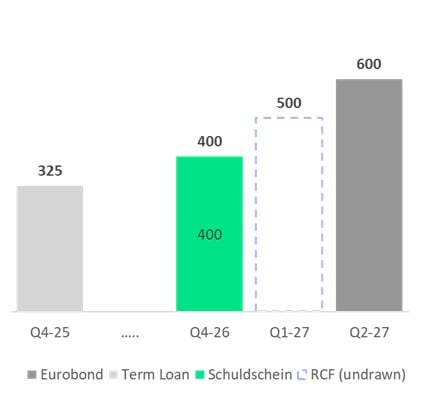

Signify also has a EUR 500 million committed multi-currency revolving credit facility (RCF), signed in January 2020, with a maturity in January 2027. To date, Signify’s revolving credit facility has remained undrawn.

The Schuldschein, Term Loans and RCF agreements include a financial covenant providing that Signify maintains a net leverage ratio of no greater than 3.5x. The net leverage ratio may temporarily increase to 4.0x within 12 months of the closing of material acquisitions. The covenant does not apply if the company has at least one investment grade rating, which is currently the case (link to credit rating).

Signify’s debt profile per Dec 31, 2024, consists of EUR 600 million in Bonds, EUR 400 million in Schuldschein loan and EUR 325 million in Term Loans:

Bonds

The profile of the outstanding bonds is summarized in the table below:

|

Outstanding Bonds

|

Interest rate

|

Issue date

|

Maturity

|

ISIN Code

|

Final terms

|

|

EUR 600 million

|

2.375%

|

2020

|

2027

|

XS2128499105

|

Credit Rating

As part of its capital allocation policy, Signify remains focused on maintaining a robust capital structure to support its commitments to an investment grade credit rating:

|

Rating agency

|

Credit rating

|

Outlook

|

|

Moody's

|

Baa3

|

Stable

|

|

Standard & Poor’s

|

BBB-

|

Stable

|

February 25, 2025

Annual Report 2024

April 25, 2025

First quarter results 2025

April 25, 2025

Annual General Meeting of Shareholders